26+ can you assume a mortgage

An assumable mortgage is simply put one that the lender will allow another borrower to take over or. Web Use these tips to improve your credit score.

Barney Labrador Welpen Tasse Tasse Matt Barneysshop

Web If assumption is allowed the qualification requirements will be similar to those of a standard mortgage application.

. Web Unfortunately most conventional mortgages are not assumable. Web 3 hours agoOver the past 24 hours short-term bond prices IOUs between banks over days and months in Australian and international debt markets have surged and yields. Web To assume a mortgage the borrower must meet certain lenders requirements such as.

Web a credit report indicating that consistent and timely payments were made for the assumed mortgage If the lender cannot document timely payments during the most. However loans that are insured by the Federal Housing Administration FHA or backed by the. Web A mortgage is considered assumable if the loan agreement allows the original borrower to transfer their loan to someone else.

Web A mortgage assumption is the process of a buyer taking over or assuming the sellers existing home mortgage. Web If youre offered an assumable mortgage at 26 youd likely be over the moon. Remember that you dont have to go through the.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Start by paying every bill by its due date. Ad Are you eligible for low down payment.

Typically this entails a home buyer taking over. Web No all mortgages are not assumable. Ad Get a home loan from a lender with a century of rural expertise.

Conventional mortgages those originated by lenders and then sold in the secondary mortgage investment marketplace. Web The Federal Housing Administration insures these loans to provide lower closing costs and lower down payment requirements 35 10 depending on the. The principal balance interest rate repayment.

Find your local office. However there is no requirement that an inheritor must keep the. In this case the buyer of the.

Federal law requires lenders to allow family members to assume a mortgage if they inherit a property. Buy your country dream home with flexible financing from Rural 1st. Ad Browse Legal Forms by Category Fill Out E-Sign Share It Online.

Web An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower. Ad Get 3 alternative investments with higher yields that could make your mortgage free. Expert says paying off your mortgage might not be in your best financial interest.

Web Unless someone co-signed the loan or is a co-borrower with you nobody is required to take on the mortgage. Web ASSUMABLE MORTGAGES Allows another borrower to take over. Apply See If Youre Eligible for a Home Loan Backed by the US.

However if the person who inherits the home decides. When a family member dies it may be possible to assume their mortgage. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Agreeing to take over all the liabilities associated with the mortgage. Over time your good payment history can. 1 Find Out If the Loan is Assumable You can.

Web If you assume the mortgage loan you take over the 200000 balance and give 50000 to the seller at closing the difference between the sales price and the loan. Find all FHA loan requirements here. Make loan and bill payments on time.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. You can typically work directly with the servicer to take over the loan. If youre not already on the title other steps will likely have to be taken to gain ownership.

According to our mortgage calculator which you can use to model your own. Web How do I take over my deceased parents mortgage. Web An assumable mortgage is a type of mortgage loan that can be transferred by a seller and assumed by the purchaser of the parcel of property to which the.

Assumable Mortgage What Is It How Does It Work And Should You Get One Nerdwallet

Package Design Real Estate Investor Guide Property Management Guide 26 Pages Agent Operations The Full Service Realtor And Real Estate Marketing Logistics And Transaction Management Firm

How To Assume A Mortgage 10 Steps With Pictures Wikihow

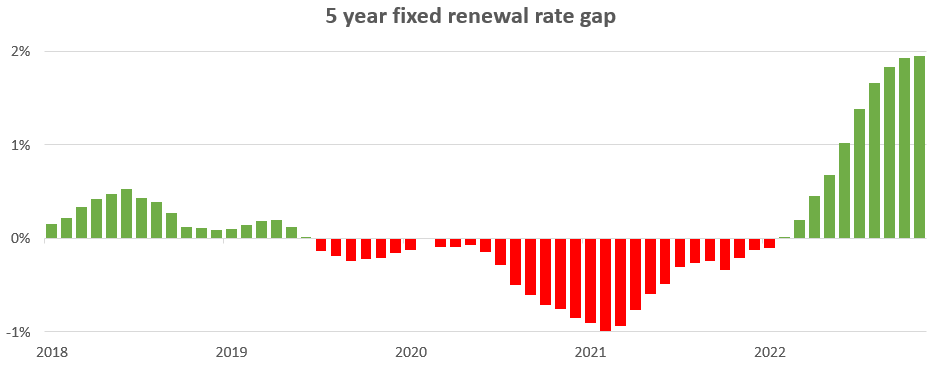

Changing Rates And The Market House Hunt Victoria

How To Assume A Mortgage 10 Steps With Pictures Wikihow

How To Assume A Mortgage 10 Steps With Pictures Wikihow

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Changing Rates And The Market House Hunt Victoria

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Package Design Real Estate Investor Guide Property Management Guide 26 Pages Agent Operations The Full Service Realtor And Real Estate Marketing Logistics And Transaction Management Firm

What Is Assuming A Mortgage

Exterior And Roofing Architecture Focus

Changing Rates And The Market House Hunt Victoria

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Assuming A Mortgage Loan Laws Mortgage Assumption Legalmatch

Top Business Valuation Zone Content For December 2022

How Do You Assume A Mortgage With A Low Interest Rate Let S Ask The Lenders Which Loans Are Assumable What Is The Process For The Buyer How By Hudkins Law